Schedule A Itemized Deductions 2022

Schedule A Itemized Deductions 2022

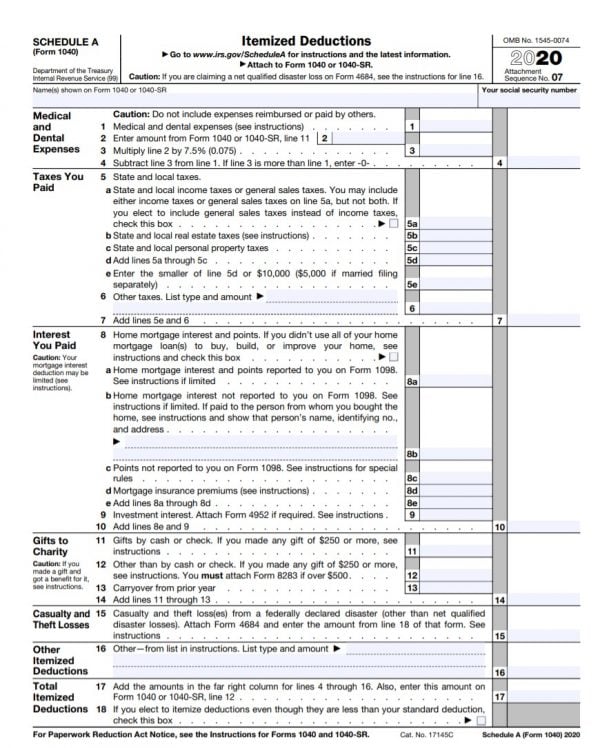

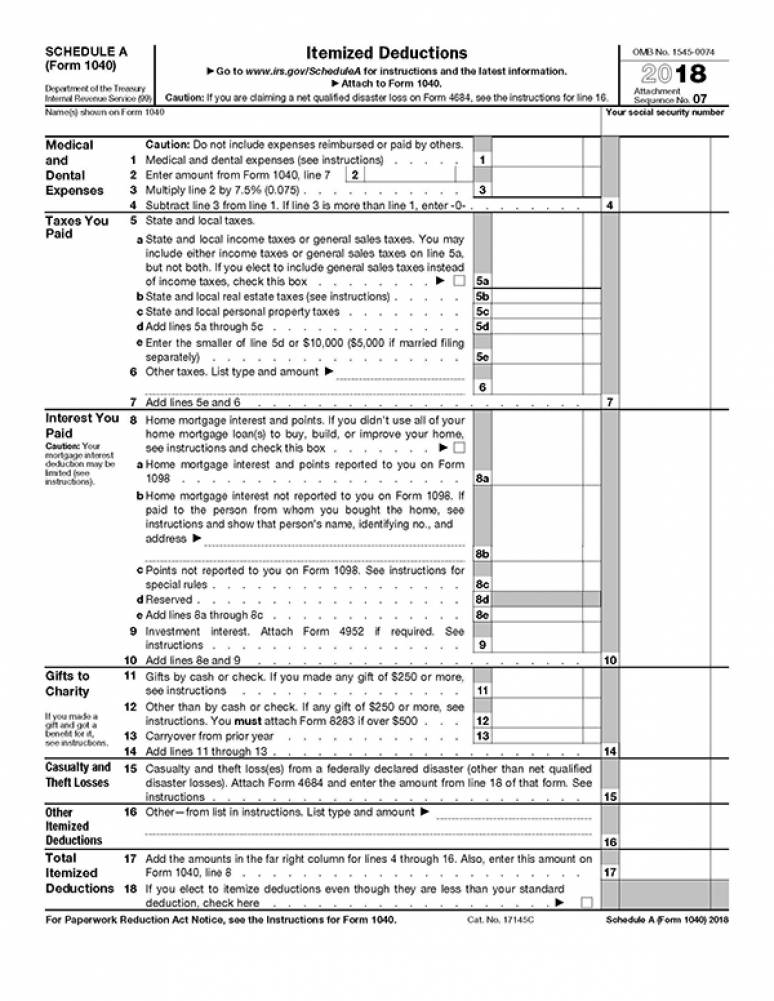

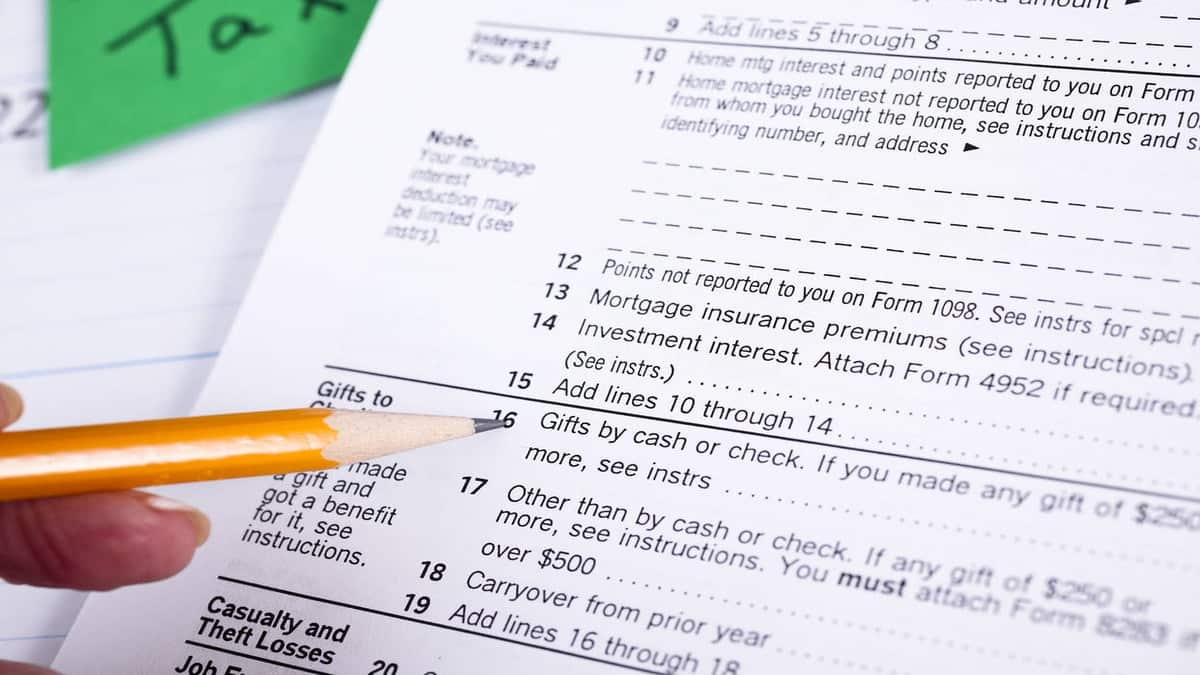

1300 for each married filer. First and foremost you must itemize deductions and attach Schedule A Itemized Deductions on your federal income tax return. In most cases your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Schedule A is a tax form that you attach to your main tax return if you want to itemize your deductions instead of taking the standard deduction.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

1 Covered by a retirement plan at work.

Schedule a itemized deductions 2022. Attach to Form 1040 or 1040-SR. You should compare claiming the foreign taxes paid as a nonrefundable credit to taking it as an itemized deduction and use whichever results in the lowest tax. Also enter this amount on.

In most cases your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. I Will Teach You To Be Rich. As there is no definite answer to whether or not you should itemize deductions in 2022 you need to see it for yourself.

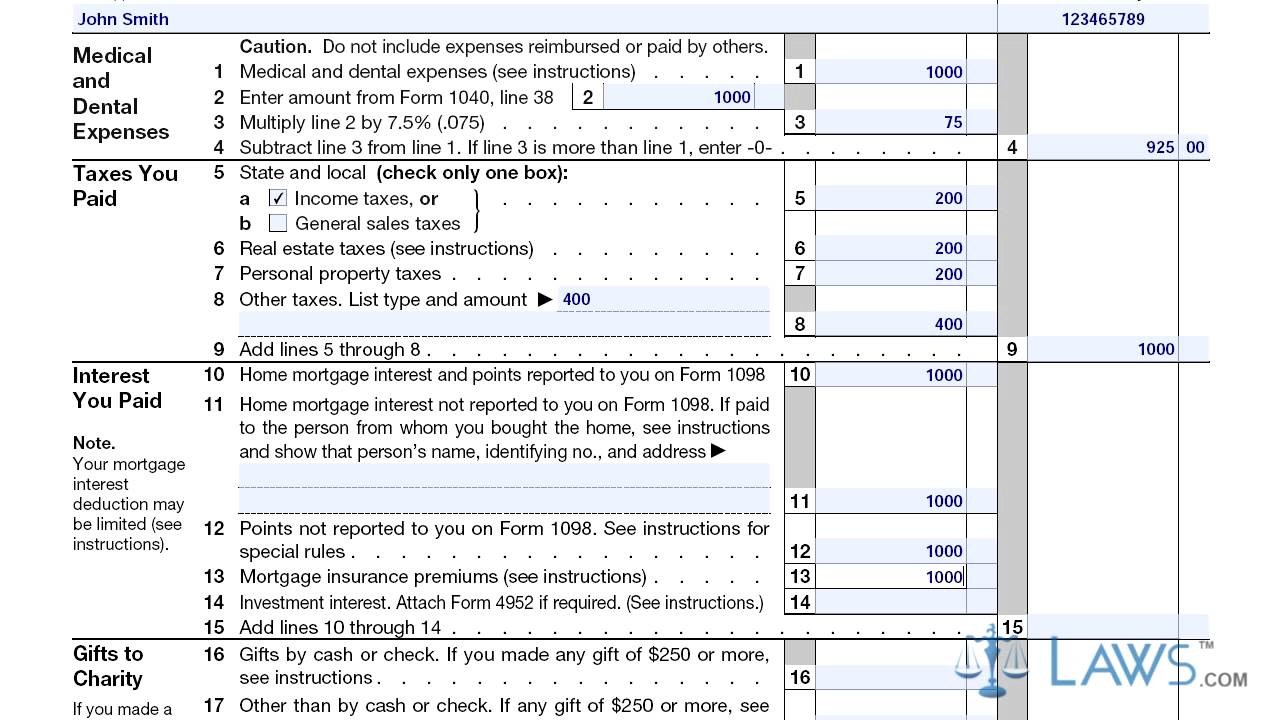

Income tax form that is used by taxpayers to report itemized deductions which can help reduce an individuals federal tax liability. Use the Mortgage Insurance Premiums Deduction Worksheet from the IRS Instructions for Schedule A if. The most common deductions are for the qualifying medical expenses state and local taxes SALT mortgage interest paid losses and charitable contributions.

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Itemized Deductions 2022 Deductions Zrivo

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Should I Itemize Deductions 2022 Federal Income Tax Taxuni

Tax Saving Strategies For High Earners Part I Stacking Brown Wealth Management

Section 16 Ia Standard Deduction For Ay 2022 23 New Tax Route

What Are The Largest Tax Expenditures Tax Policy Center

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

Schedule A Itemized Deductions Miller Financial Services

Https Www Taxpolicycenter Org Sites Default Files Publication 160472 An Updated Analysis Of Former Vice President Bidens Tax Proposals 1 Pdf

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Itemized Deductions Form 1040 Schedule A Youtube

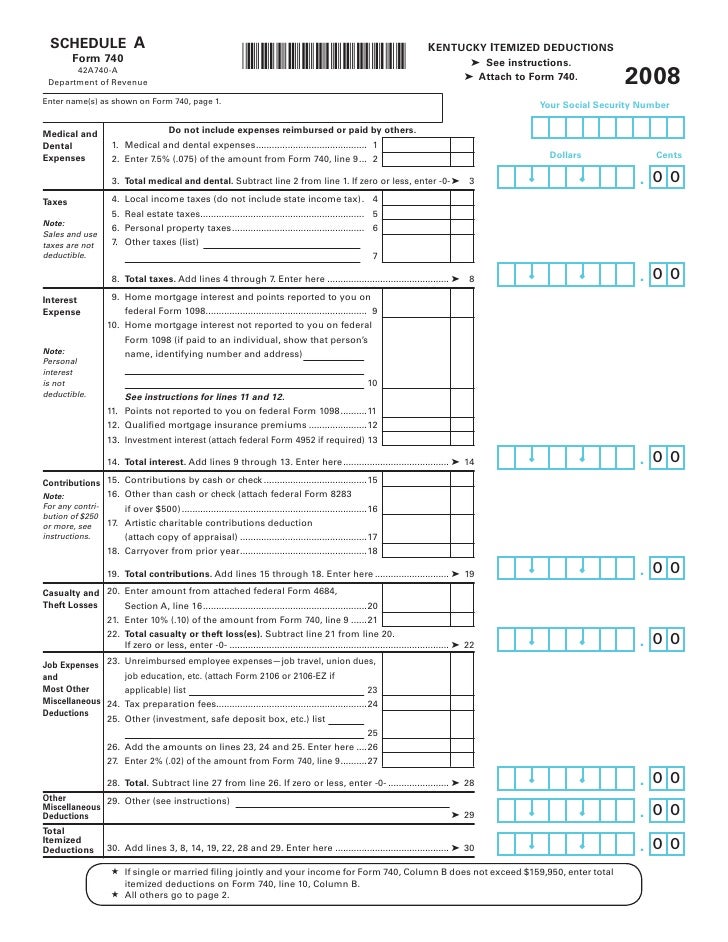

Schedule A 740 Kentucky Itemized Deductions Form 42a740 A

Some Changes That May Affect Next Year S Tax Return The New York Times

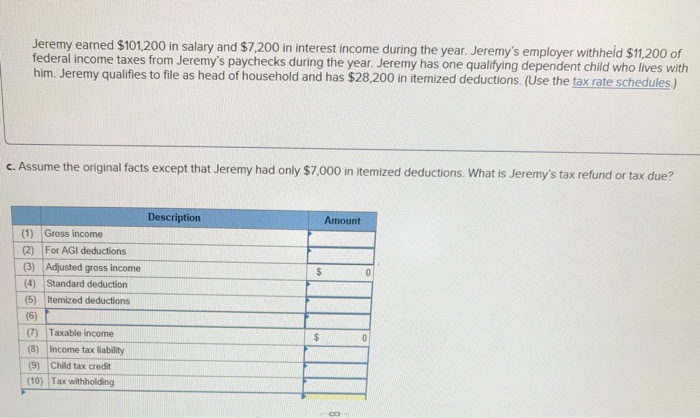

The Question Is Assume The Original Facts From The Chegg Com

Post a Comment for "Schedule A Itemized Deductions 2022"