Irs 2022 Schedule C

Irs 2022 Schedule C

Surcharge is levied on the amount of income-tax at following rates if total income of an assessee exceeds specified limits-. If you are a resident alien you can take the deductions allowed on Schedule A Form 1040. For example we may disclose your tax information to the. There isnt a limit on how many times you can change the accounting method but you must wait for the tax year to end.

Checklist For Irs Schedule C Profit Of Loss From Business 2019 Tom Copeland S Taking Care Of Business

250000 - - Rs.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

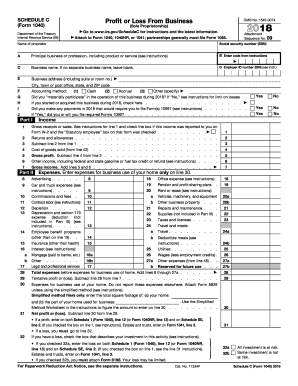

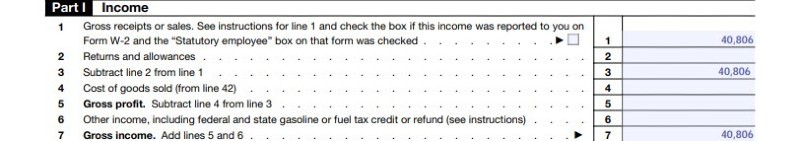

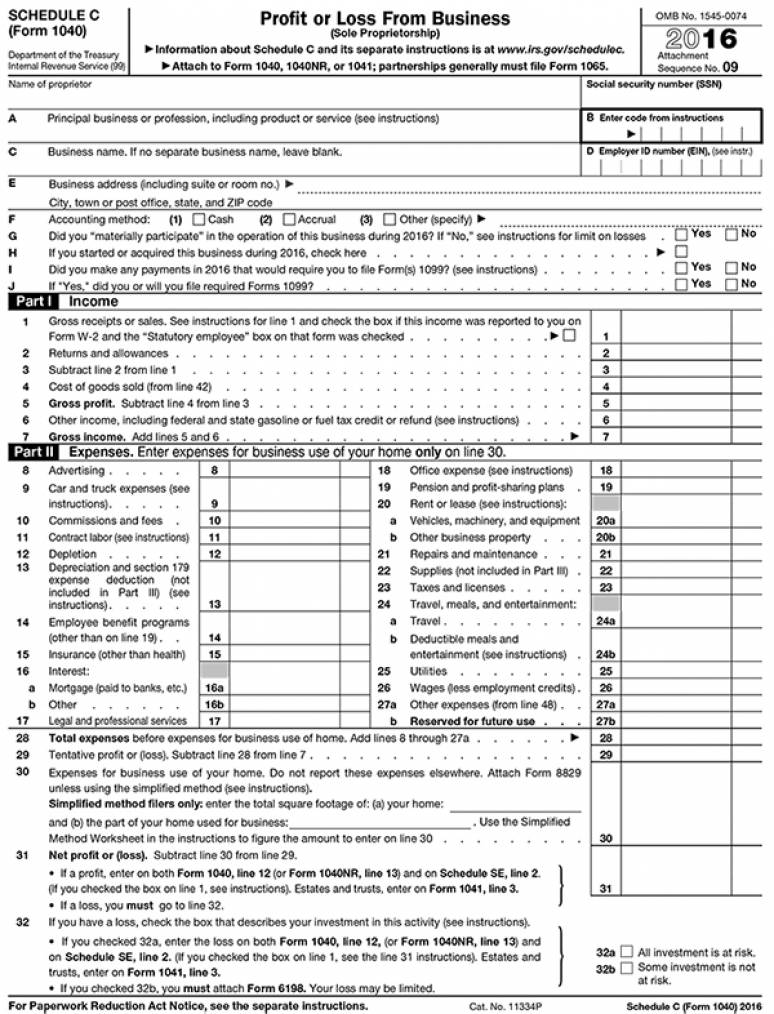

Irs 2022 schedule c. However you can deduct one-half of your self-employment tax on Schedule 1 Form 1040 line 14 but if filing Form 1040-NR then only when covered under the US. Schedule C Form 1040 or 1040-SR 2019. Was there any change in determining quantities costs or valuations between opening and closing inventory.

Information about Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship including recent updates related forms and instructions on how to file. Prepare and eFile your IRS and State 2020 Tax Return s by April 15 2021. See the Instructions for Schedule A Form 1040.

The IRS generally releases the inflation adjustments towards the end of the year at around mid-December. Choosing the accounting method on Schedule C. The filer is involved in the activity with continuity and.

Checklist For Irs Schedule C Profit Of Loss From Business 2019 Tom Copeland S Taking Care Of Business

Checklist For Irs Schedule C Profit Or Loss From Business 2018 Tom Copeland S Taking Care Of Business

1040 Schedule C 2021 Schedules Taxuni

Irs Schedule C 1040 Form Pdffiller

Checklist For Irs Schedule C Profit Or Loss From Business 2015 Tom Copeland S Taking Care Of Business

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

How To File Schedule C Form 1040 Bench Accounting

Step By Step Instructions To Fill Out Schedule C For 2020

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Step By Step Instructions To Fill Out Schedule C For 2020

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 2016 Package Of 100 U S Government Bookstore

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

Irs Releases New Draft Instructions For Sch K 2 And K 3 Tax Practice Advisor

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Tips On Using The Irs Schedule C Lovetoknow

Taxwise Webinar At The 2021 Irs Virtual Tax Forum Maximizing Schedule C Deductions Youtube

Post a Comment for "Irs 2022 Schedule C"